Business Insurance in and around Lawrenceburg

One of the top small business insurance companies in Lawrenceburg, and beyond.

No funny business here

Help Prepare Your Business For The Unexpected.

Whether you own a a pet groomer, a clock shop, or a stained glass shop, State Farm has small business coverage that can help. That way, amid all the various options and decisions, you can focus on your next steps.

One of the top small business insurance companies in Lawrenceburg, and beyond.

No funny business here

Get Down To Business With State Farm

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure all bases are covered. That's why State Farm has coverage options for commercial liability umbrella policies, worker’s compensation, business owners policies, and more.

Let's talk business! Call Stan Simmons today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

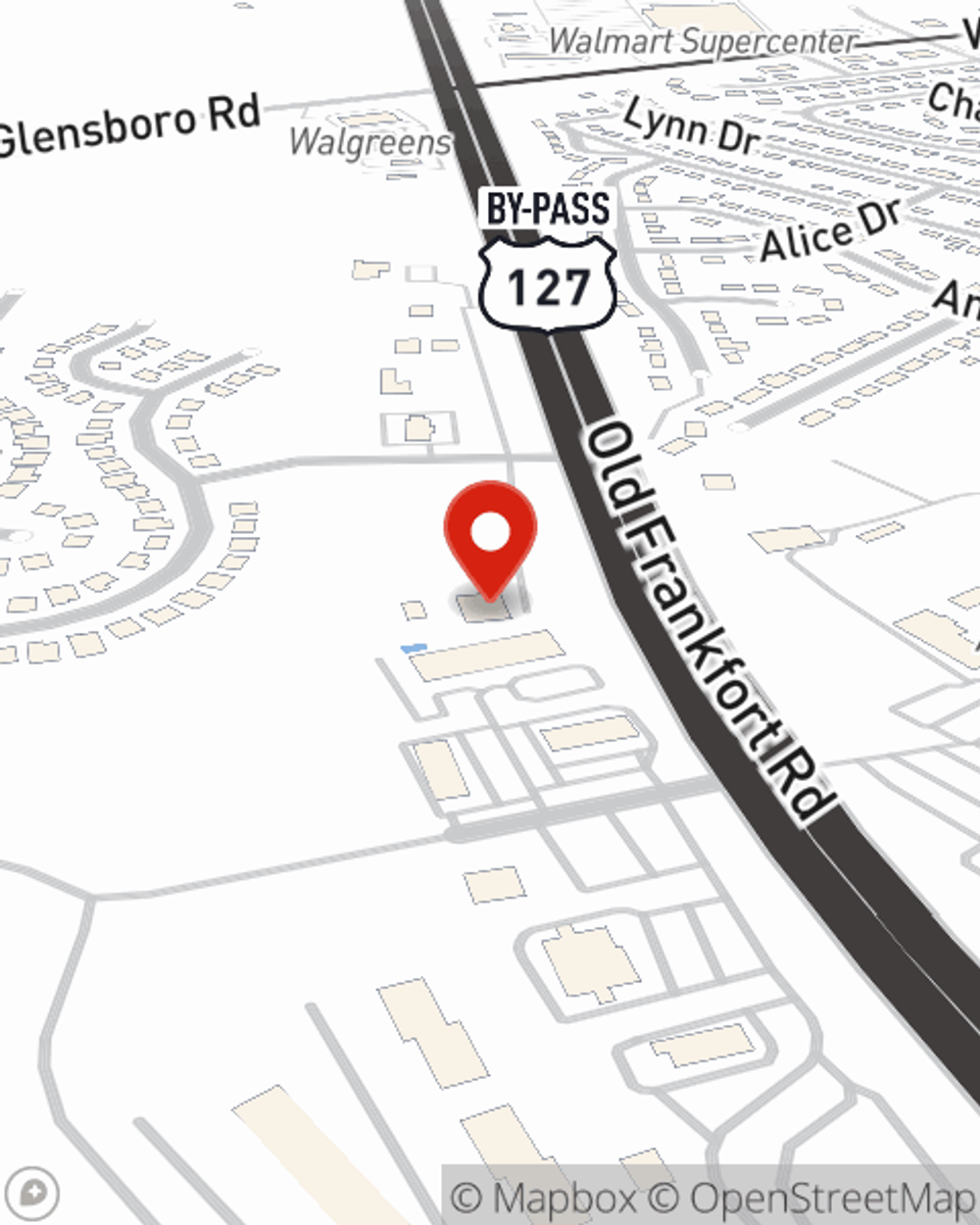

Stan Simmons

State Farm® Insurance AgentSimple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.